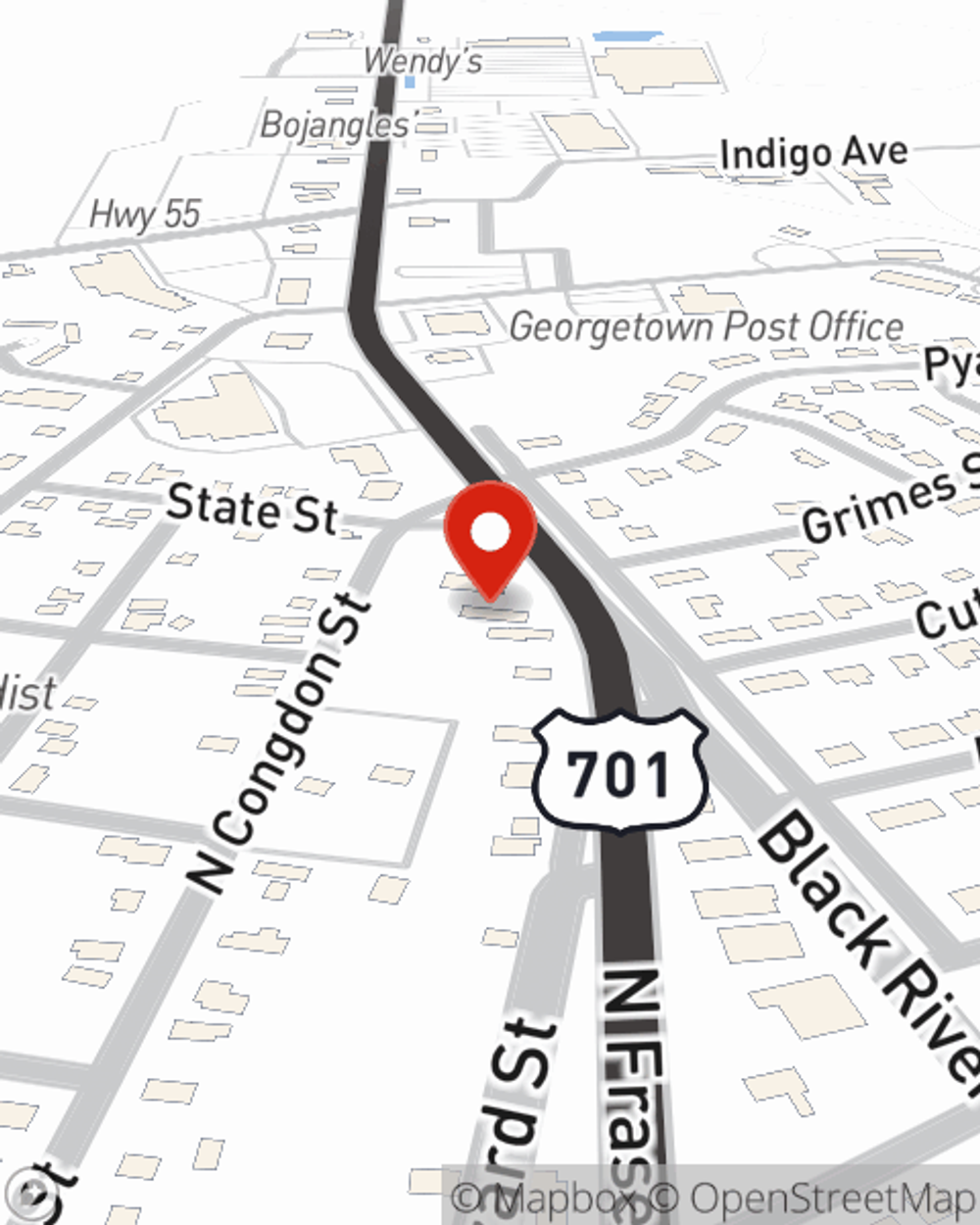

Business Insurance in and around Georgetown

Calling all small business owners of Georgetown!

Insure your business, intentionally

Business Insurance At A Great Price!

Small business owners like you have a lot on your plate. From customer service rep to tech support, you do whatever is needed each day to make your business a success. Are you a barber, an optician or a dentist? Do you own an appliance store, a meat or seafood market or an ice cream shop? Whatever you do, State Farm may have small business insurance to cover it.

Calling all small business owners of Georgetown!

Insure your business, intentionally

Customizable Coverage For Your Business

Your small business is unique and faces specific challenges. Whether you are growing a shoe repair shop or a cosmetic store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your speciality, you may need more than just business property insurance. State Farm Agent Linda Edwards can help with business continuity plans as well as key employee insurance.

As a small business owner as well, agent Linda Edwards understands that there is a lot on your plate. Reach out to Linda Edwards today to discuss your options.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Linda Edwards

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.